Bulk Payment Entry

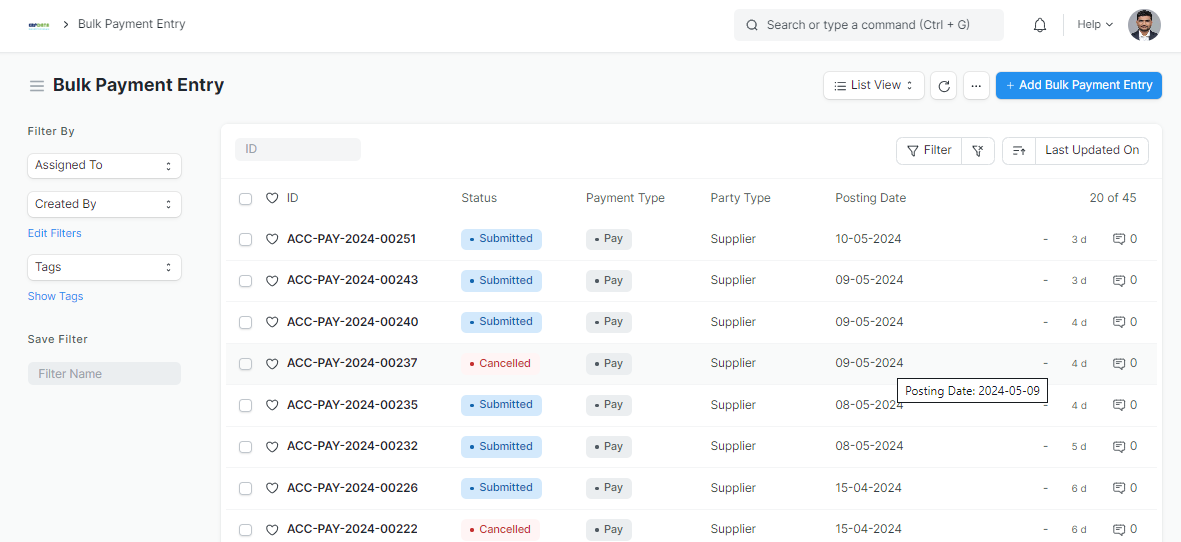

Home > Bulk Payment Entry

Steps to create Bulk Payment Entry

Step 1: Go to bulk payment entry and click on "Add bulk payment entry"

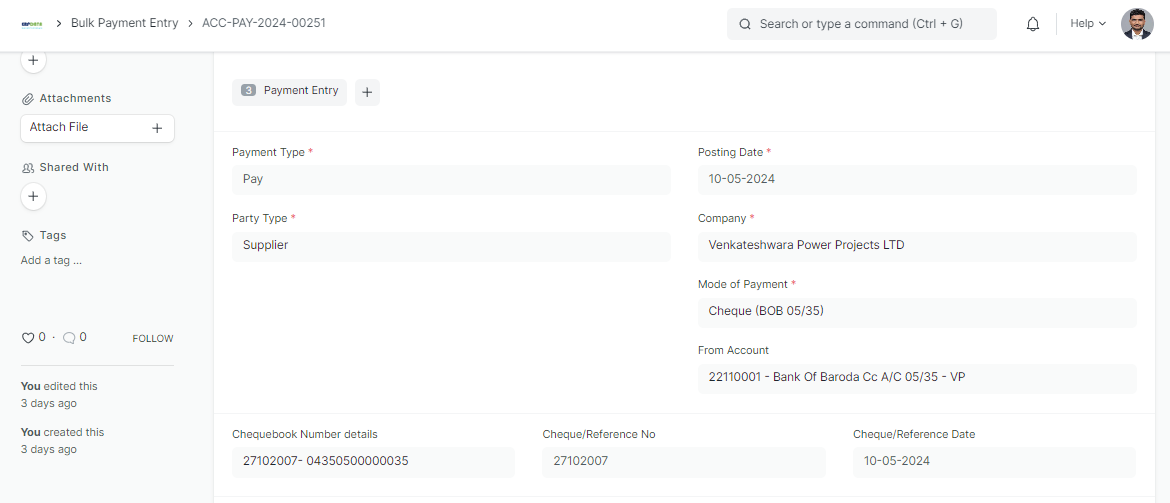

Step 2:

Series: Series will auto select as per doctype

Payment Type: Enter the payment purpose type like pay, receive, internal transfer

Party Type: Select the party type like supplier, customer, etc.

Posting Date: Posting date will auto fill as per the current date

Company: Company auto select as per session default

Mode of Payment: Select the mode of payment like bank draft, cash, cheque, etc.

From Account: Select the account type for payment

Chequebook Number details: Enter chequebook number

Cheque/Reference No: Enter chequebook reference number

Cheque/Reference Date: Enter checquebook date

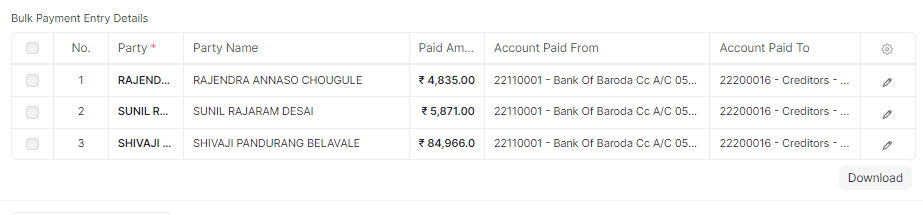

Step 3: Bulk Payment Entry Details

Party: Select the party from dropdown. If you selected the party type as a supplier then supplier list will shown in dropdown

Party Name: From the party code party name will auto fetch from

Paid Amount: Enter the paid amount to party

Account Paid From: Select the account for payment

Account Paid To: select the account type for payment

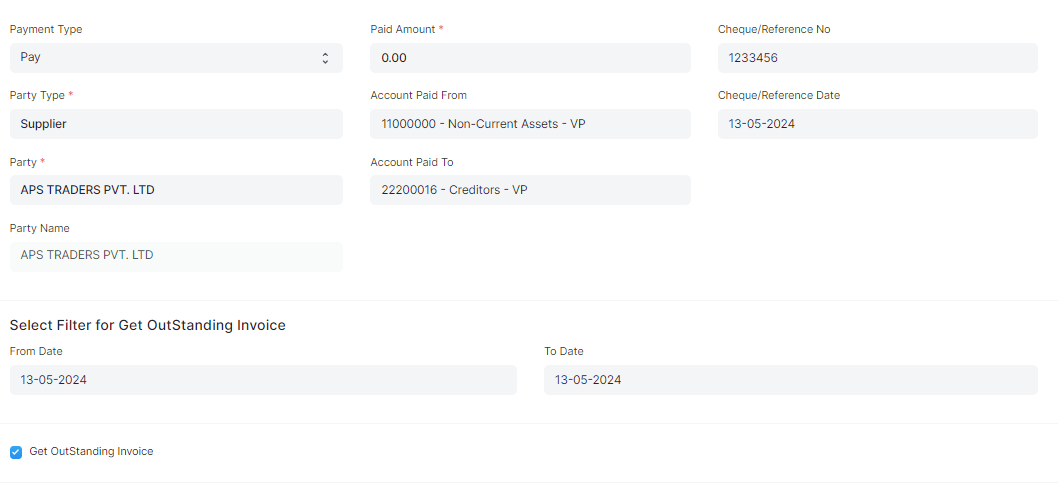

From Date: Select the outstanding invoice start date (For Invoice)

To Date: Select the outstanding invoice end date (For Invoice)

Get Outstanding Invoice: Mark this field to get results for applied date filters

From Date: Select outstanding order start date (For order)

To Date: Select outstanding order end date (For order)

Get Outstanding Order: Mark this field to get results for applied date filters

From Date: Select the start date of outstanding invoice or order

To Date: Select the end date of outstanding invoice or order

*Note: User can apply date filter by individual or group. If user want to apply date format for individual then apply for "edit" option. If user want to apply date filter for group then user can use bulk filter.

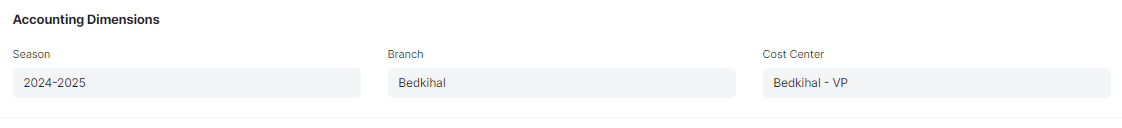

Step 4: Accounting Dominations

Season: Enter the season

Branch: Enter branch

Cost Center: Enter the respective cost center

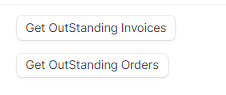

Step 5: Get Outstanding invoices / order

After making the on Get Outstanding invoices / Get Outstanding order system will show you the list of purchase invoice or orders from the selected date filters

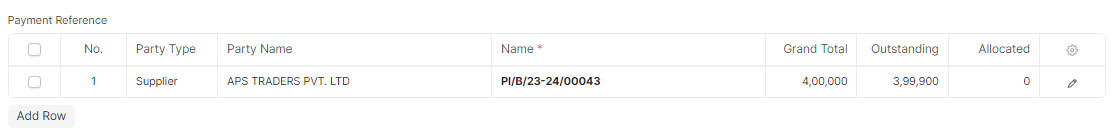

Step 6: Payment Reference

Party Type, Party Name: This info will auto fetch from above data

Name: This indicates the purchase invoice / order id

Grand Total: Grand total amount as per purchase invoice / order

Outstanding: Outstanding amount as per purchase invoice / order

Allocated: Enter the paid amount

*Note: This amount must be same as Paid Amount

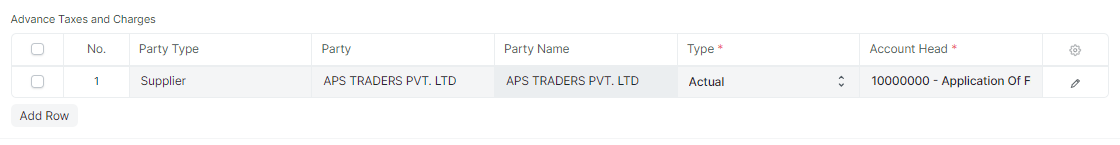

Step 7: Advance Taxes and Charges

Party Type, Party, Party Name: As per above info

Type: Select type of tax or any other charges

Account Head: Select the account type for tax and other charges

Step 8: Payment Entry Deduction

Party Type, Party, Party Name, Account: As per above info

Cost Center: Enter the cost center for payment deduction

Step 9: Click on "Save"